Does Delta Make Crypto Futures and Options Trading Simple for Indian Traders?

India’s financial landscape is evolving rapidly, and one of the most notable shifts has been the growing interest in crypto derivatives trading. From metro cities to tier-2 and tier-3 regions, more Indians are exploring crypto futures and options not just as speculative tools but as smarter ways to hedge risk or seek additional income.

For newcomers stepping into this world, the concept of trading contracts instead of actual crypto can feel daunting. That’s where crypto trading platforms like Delta Exchange play a key role.

In this blog, we’ll review how Delta Exchange makes these trading products approachable and why both beginners and experienced traders are finding it a strong platform to build their strategies.

Getting to Know Delta Exchange

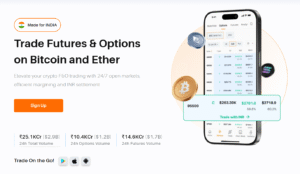

Delta Exchange: A leading crypto derivatives platform

Founded in 2018, Delta Exchange was built with a focused vision: making crypto derivatives accessible to a wider audience. Over time, it has scaled into a credible platform for Bitcoin trading and other altcoins.

Unlike many overseas platforms, Delta supports INR transactions directly, giving Indian traders the comfort of Rupee deposits and withdrawals while also being compliant with FIU-India’s regulatory requirements.

Its advanced tools and deep liquidity help you execute strategies effectively, and hitting $4.4 billion in daily trading volume proves the platform can handle high-frequency trades at scale.

Crypto Futures and Options on Delta Exchange

Trade crypto futures and options smoothly on Delta Exchange

If you’re exploring Delta, the platform gives you multiple ways to trade through its derivatives suite:

- Futures contracts: A simple way to speculate on asset prices without owning them. Contracts expire on a specific fixed date and can be traded long or short, with leverage options as high as 200x on select assets.

- Options contracts: European-style contracts on BTC and ETH allow you to set directional bets with more flexibility. Since they’re only exercisable at expiry, they suit traders with a clear timeframe-based view.

Aside from crypto futures and options, Delta also caters to trackers: a lighter alternative to derivatives. Trackers closely mirror the price of BTC and other altcoins without leverage or expiry. They work like spot trading but stay within the crypto derivatives trading environment of the Delta Exchange app.

Why Indian Traders Are Comfortable on Delta Exchange

A major reason behind Delta’s growing adoption is its ability to make complex products less intimidating. Let’s explore some standout features:

1. Direct INR support

Deposits and withdrawals in Indian Rupees save users from conversion fees and additional technical hassle, making it smoother for Indians outside the crypto-native crowd.

2. Low entry barriers

Not everyone wants to start big. With BTC contracts beginning around ₹5,000 and ETH near ₹2,500, traders can test positions without heavy commitments.

3. Automation and trading bots

From strategy back-testing to market-entry triggers, automated trading support helps users execute ideas without manually monitoring charts all day. APIs further allow advanced setups for algorithmic traders.

4. Leverage with risk controls

The ability to scale up trades using leverage attracts experienced traders, but Delta balances this with stop-loss, take-profit, and hedging tools that keep risk management within reach.

5. Demo account and payoff charts

Beginners can first simulate trades with a free demo account, while payoff charts give transparency on best and worst-case scenarios for every position. This upfront clarity prevents impulsive mistakes.

Together, these features form a safety net for those still warming up to derivatives.

Ease of Use and Support

Beyond products and tools, what really stands out about Delta is its user experience.

- Both website and app are designed for quick navigation – uncluttered charts, contracts, and tools are accessible without overwhelming menus.

- 24/7 customer support ensures that if you hit a roadblock – technical or account-related – you get timely guidance.

This matters for Indian traders still adapting to derivatives. The assurance of responsive support adds confidence, especially for those experimenting with advanced strategies for the first time.

Easy Ways to Start Trading on Delta Exchange

If you’re new and want to begin, here’s what to do:

- Sign up on Delta Exchange. It’s quick and just needs your email or mobile number.

- Add or take out money in rupees using UPI or bank transfer, without any fuss.

- Check out the crypto futures and options, then think about which trading strategy might suit you.

- Place your order easily using the platform’s simple tools and hit confirm.

- If you make a profit, withdraw your earnings straight to your regular bank account in INR.

The process is designed to be seamless for Indian users who don’t want complications with wallets or external currency conversions.

The Bottomline

So, does Delta Exchange make crypto futures and options trading simple for Indian traders? The short answer: yes. By aligning with traders’ needs – from INR support and low entry thresholds to algo trading bots and transparent tools – Delta has carved a space where both newcomers and seasoned players can explore derivatives with greater ease.

While crypto remains volatile and every trade carries risk, Delta helps simplify the learning curve. If you’re exploring crypto futures and options, Delta offers a practical, well-balanced starting point without overwhelming you in jargon or unnecessary hurdles.

To start trading crypto futures and options, visit www.delta.exchange or join the community on X for the latest updates.

Disclaimer: Crypto trading is highly risky and may not be suitable for all investors. Always conduct thorough research before investing funds.