How is The Value of a Cryptocurrency Determined?

Cryptocurrency, a revolutionary digital currency, has taken the financial world by storm. As more people become interested in investing and online cryptocurrency trading, it’s essential to understand the fundamental question: How is the value of a cryptocurrency determined? In this article, we’ll delve into the intriguing history of cryptocurrencies, explore the factors that play a pivotal role in shaping their value, discuss regulations in cryptocurrency trading in SA, and guide you through opening a trading account on a reputable cryptocurrency trading platform.

History of Cryptocurrency

To comprehend the present, we must first explore the past. The concept of cryptocurrency isn’t new, with roots dating back to the late 20th century. However, it wasn’t until 2009 that Bitcoin, the pioneering cryptocurrency, was introduced by an enigmatic individual or group known as Satoshi Nakamoto. The creation of Bitcoin marked the beginning of a new era, igniting the development of numerous other cryptocurrencies, each with its unique features and purposes.

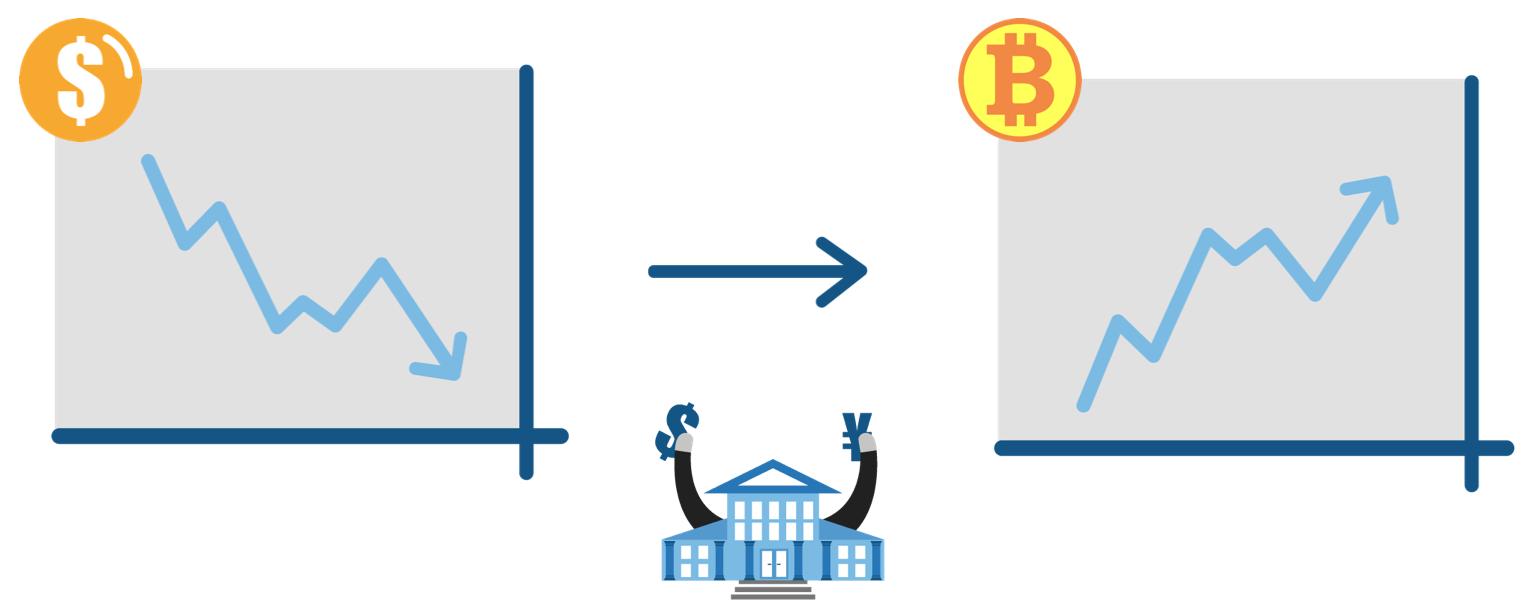

Factors Determining The Value of Cryptocurrency

The value of a cryptocurrency isn’t determined by traditional factors like physical assets or economic indicators. Instead, its valuation relies on a complex interplay of various factors:

- Scarcity and Supply: Many cryptocurrencies have a predetermined supply limit. For instance, Bitcoin has a maximum supply of 21 million coins. This scarcity can influence demand and subsequently impact the value.

- Utility and Use Cases: The practical applications of a cryptocurrency within a particular industry or ecosystem can significantly impact its value. Cryptocurrencies like Ethereum enable the creation of decentralised applications, adding to their utility.

- Market Demand and Speculation: Just like traditional stocks, the demand for a cryptocurrency in the market can lead to fluctuations in its value. Speculative trading often drives short-term price changes.

- Technological Innovation: Technological advancements and upgrades within a cryptocurrency’s underlying blockchain can enhance its functionality and desirability, affecting its value.

- Market Sentiment: The perception of a cryptocurrency among investors, news cycles, and global events can influence trading decisions and, consequently, its value.

Is Cryptocurrency Trading in SA Regulated?

Cryptocurrency trading in South Africa exists within a regulatory landscape that continues to evolve. While the South African Reserve Bank (SARB) has not outrightly banned cryptocurrencies, it has issued cautionary statements to citizens about the inherent risks associated with investing and trading in these digital assets. The absence of a specific legal framework for cryptocurrencies leaves a degree of uncertainty for traders and investors.

As of now, South Africa has taken a pragmatic approach by focusing on monitoring and understanding the cryptocurrency space rather than imposing strict regulations. The country’s regulators are actively exploring ways to balance innovation with consumer protection and financial stability. This includes considering potential licensing requirements for cryptocurrency service providers and ensuring compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Given this evolving landscape, individuals engaged in cryptocurrency trading within South Africa are advised to stay updated with the latest regulatory developments, exercise due diligence when choosing trading platforms, and adhere to any guidelines provided by authorities. As the market matures and regulatory clarity emerges, participants can expect a safer and more regulated environment for cryptocurrency trading in the country.

Open a Trading Account and Start Online Cryptocurrency Trading

If you’re ready to dive into the world of cryptocurrency trading, it’s essential to choose a reputable and secure cryptocurrency trading platform like Banxso – Online Trading Brokerage Platform. Follow these steps to get started:

- Research: Compare different trading platforms based on factors like fees, security measures, available cryptocurrencies, and user interface.

- Registration: Sign up on the selected platform by providing the required information and verifying your identity as per their Know Your Customer (KYC) process.

- Deposit Funds: Deposit your preferred amount of fiat currency into your trading account using accepted payment methods.

- Choose Cryptocurrencies: Explore the variety of cryptocurrencies available for trading and choose the ones you’re interested in.

- Start Trading: Utilise the trading tools and resources provided by the platform to execute buy and sell orders based on your analysis and strategy.

- Security Measures: Enable two-factor authentication (2FA) and use secure passwords to protect your account from unauthorised access.

To conclude, understanding how the value of a cryptocurrency is determined is a critical step in becoming a successful cryptocurrency trader. From its intriguing history to the intricate factors influencing its value, the world of cryptocurrency is as dynamic as it is promising. As you step into the realm of cryptocurrency trading, remember to prioritise education, research, and compliance with regulatory guidelines to make the most of this exciting financial landscape.